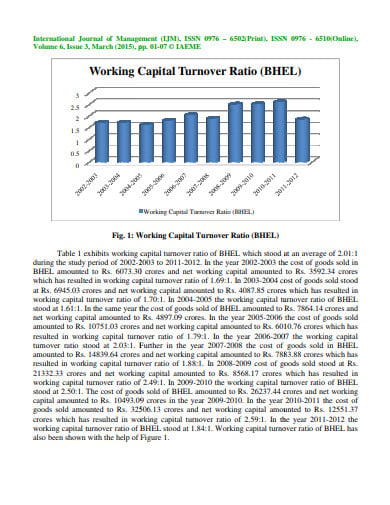

working capital turnover ratio interpretation

240000 140000 280000 1000002. High Working Capital Turnover Ratio indicates the company is very efficiently using the current assets and liabilities to support its sales.

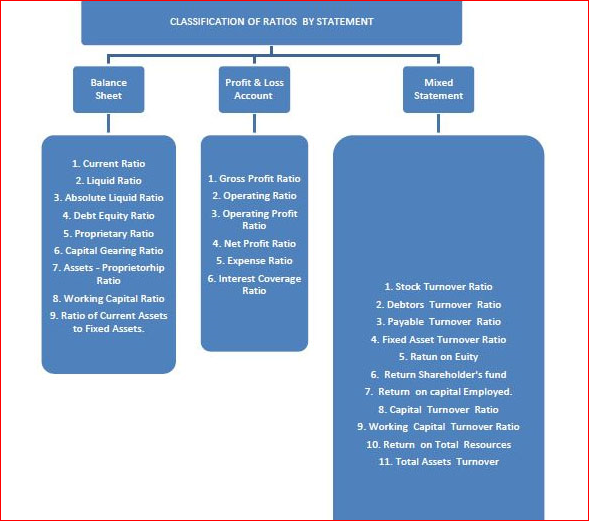

Ratio Analysis Classification Of Ratios And Liquidity Ratio By Rajan Vishwakarma Medium

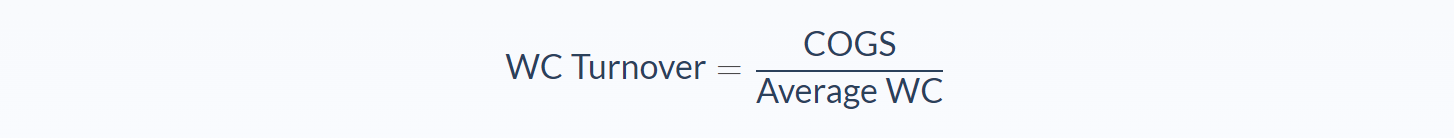

WC Turnover Ratio Revenue Average Working Capital.

. Net Working Capital Turnover Sales Net Current Assets. Putting the values in the formula of working capital turnover ratio we get. Average working capital.

Significance and Interpretation. Increasing ratio indicates that working capital is more active. The Working Capital Turnover Ratio refers to the ratio of the Net sales and the average Working Capital of the company.

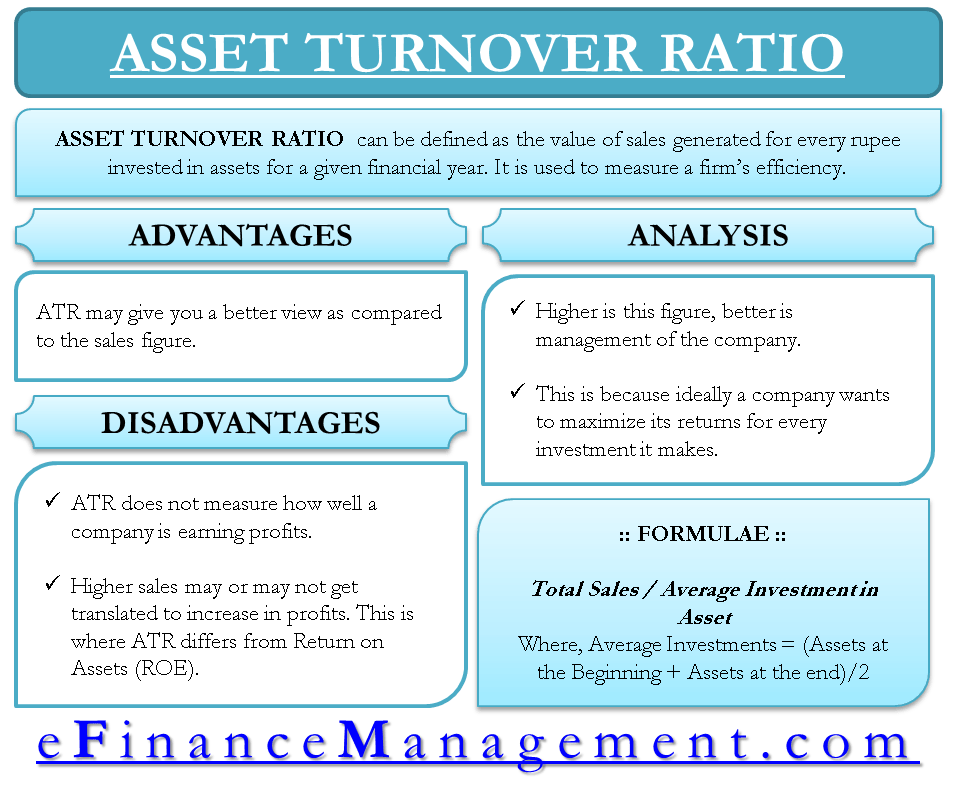

All else being the same Superpower Inc. The working capital turnover ratio is an accounting ratio that determines how effectively a business utilises its working capital to generate revenue. Working Capital Turnover Ratio Calculation and Analysis.

The formula to measure the working capital turnover ratio is as follows. It is also an activity ratio. For example the working capital turnover ratio formula does not take into account unsatisfied employees or periods of recession both of which can influence a businesss.

The working capital turnover ratio of Exide company is 214. Is generating Sales of 1M with a working capital of 200K but it is taking Villian Corp. Working capital is current assets minus current liabilities.

We calculate it by dividing revenue. The working capital turnover ratio of Exide company is 214. The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a business earns as a result.

Interpretation of this ratio should be done when inter-firm or inter-period comparison is being done. Working Capital Ratio Formula Example Analysis Calculator 2 days ago Mar 24 2021 An example calculation of the working capital ratio would be if a company has 10000 in current. It means each dollar invested in.

It means each dollar invested in working capital has contributed 214 towards total sales revenue. Now working capital Current assets Current liabilities. Working capital can be calculated by.

It is a measurement of the efficiency with which the Working Capital is. Working capital turnover is a financial ratio to measure how efficiently companies use their working capital to generate revenue. Now that Jen has the income statement and balance sheet she finds the following lines items and amounts.

A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and. First lets calculate the average working capital. 500K to produce the same amount of sales.

100000 40000. It also includes ratio. WC dfrac 100 000 180 000 2 140 000 latex Now we can calculate the working capital turnover.

The reciprocal of the ratio will become 025 that is the reciprocal of 41 is 14.

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula Example Analysis Calculator

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Financing What It Is And How To Get It

Working Capital Turnover Formula And Calculator

9 Activity Ratios Analysis Ideas Analysis Financial Ratio Trend Analysis

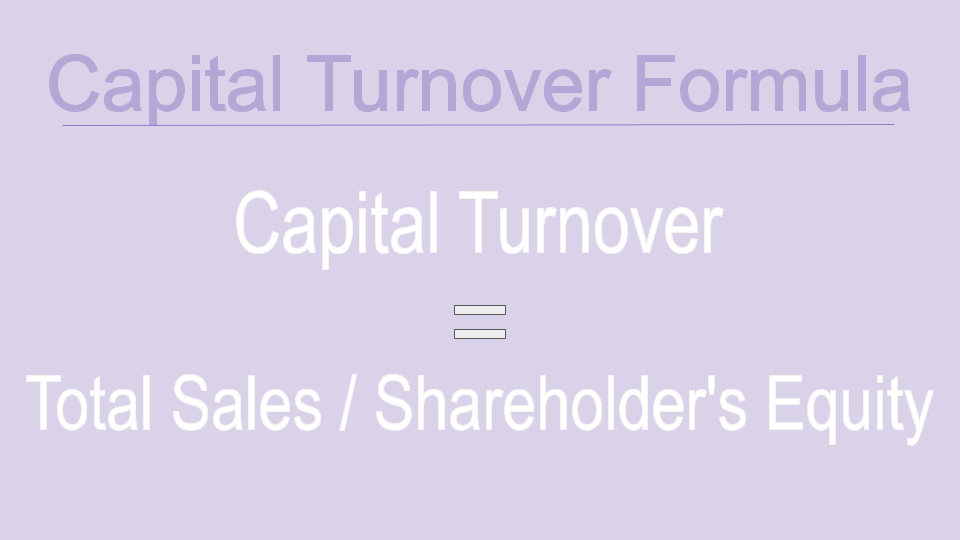

What Is Capital Turnover Basics Definition Sendpulse

Working Capital Management Acca Global

Working Capital Turnover Ratio What It Is And How To Calculate It Planergy Software

Working Capital Turnover Ratios Universal Cpa Review

Ratio Analysis Class 12 Notes And Examples Accountancy Arinjay Academy

Working Capital Turnover Ratios Universal Cpa Review

Ratio Analysis Classification Of Liquidity Ratio

Working Capital Cycle Efinancemanagement

Working Capital Turnover Ratio Double Entry Bookkeeping

Working Capital Turnover Ratio Abc Study Youtube

19 Turnover Ratio Analysis Templates Google Docs Word Pages Pdf Free Premium Templates